In 2024, millions of Americans are receiving direct payments as part of relief programs to help with rising costs and economic challenges. These payments, such as $2400 in California and $550 in several other states, are designed to provide financial support for individuals and families. If you’re wondering whether you qualify, when to expect your payment, and how to avoid scams, this guide has you covered.

What Are the $2400 & $550 Direct Payments in 2024?

The $2400 and $550 direct payments are part of various state and federal programs designed to offer financial relief. The $2400 payment is specifically for California residents, and it’s a part of the Middle Class Tax Refund (MCTR) program, which started as a response to the financial hardships caused by the COVID-19 pandemic. On the other hand, the $550 payment is available in several states, including Colorado, Illinois, and New Mexico, and it is typically offered as part of income tax rebates or relief programs.

The $2400 Payment: California’s Middle Class Tax Refund

California’s $2400 payment is part of the Middle Class Tax Refund program, which was launched to support residents dealing with inflation and the effects of the pandemic. Here’s what you need to know:

Eligibility for the $2400 Payment

To qualify for the $2400 payment, you needed to meet the following criteria:

- California Residency: You must have been a California resident in 2020.

- Income Requirements:

- Individuals must have earned less than $75,000.

- Married couples must have earned less than $150,000 combined.

- Tax Filing: You must have filed a 2020 California state tax return.

- Social Security Number (SSN): Only those with a valid SSN were eligible.

- Dependents: Families with dependents were eligible for higher amounts, but still had to meet the income limits.

Payment Dates

The majority of the $2400 payments were issued between October 2022 and January 2023. There will be no new $2400 payments in 2024, but if you missed the previous payment, you may still be eligible for retroactive payments. Make sure to check the California Franchise Tax Board for updates on your payment status.

The $550 Payment: Available in Several States

The $550 payment is available in many states, including Colorado, Illinois, and New Mexico. These payments are usually part of state-level tax rebates or relief efforts aimed at easing the financial burden caused by inflation and rising living costs.

Eligibility for the $550 Payment

While eligibility varies by state, here are the general requirements:

- State Residency: You must be a resident of the state offering the payment.

- Income Requirements: States typically offer these payments to low- and middle-income households.

- Tax Filing: You must have filed state taxes for the prior year (usually 2022).

Example States Offering the $550 Payment:

- Colorado: The state issued $550 payments to eligible taxpayers as part of the Taxpayer Stimulus Program in 2023.

- Illinois: Illinois also provided a $550 income tax rebate to eligible residents in 2023.

- New Mexico: New Mexico continues to offer one-time $550 payments in 2024 as part of its inflation relief efforts.

Payment Dates

Payment dates for the $550 payment vary by state. Some states issued payments in 2023, while others are planning payments in 2024. Always check your state’s official tax office website for the exact dates and eligibility details.

How to Check Your Payment Status

If you’re wondering when you’ll receive your payment, the best way to check the status is by visiting the IRS website or your state’s official government portal. If you missed your payment or are having trouble, make sure your tax filings are up to date and correct.

Potential Scams to Watch Out For

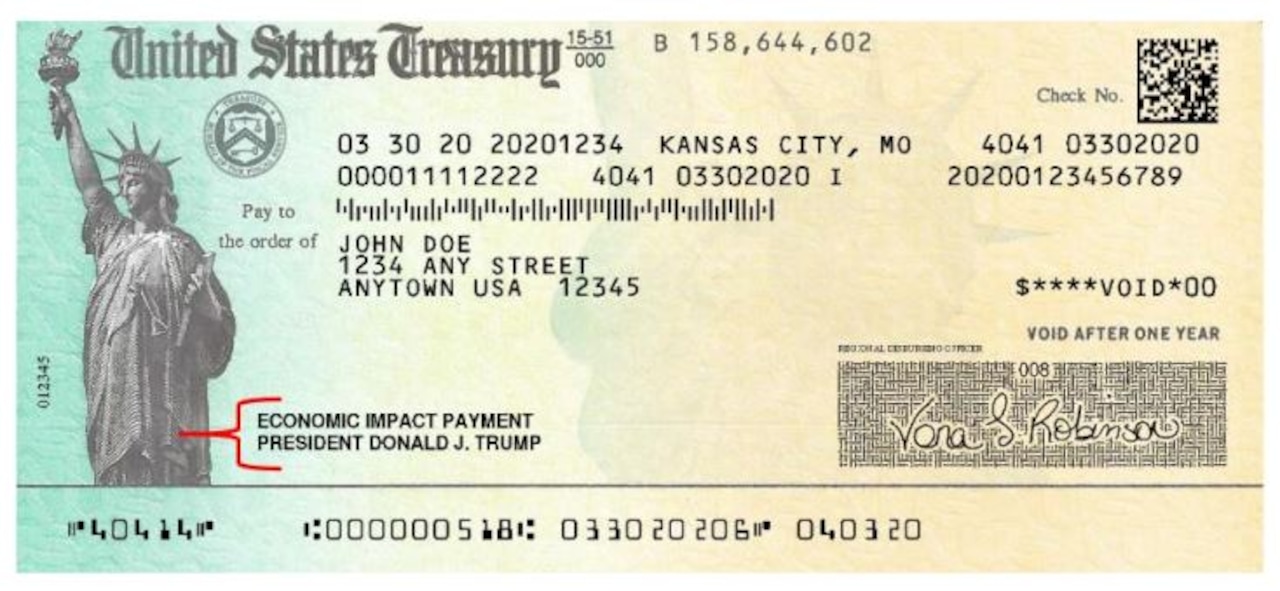

With relief payments, there’s always a risk of scams. Fraudsters may try to steal personal information or trick you into paying fees to receive your payment.

How to Avoid Scams:

- Never Pay a Fee: Legitimate relief payments will never ask for a fee.

- Verify Communications: Government agencies like the IRS or your state will never ask for sensitive information over the phone or through email.

- Check Official Sources: Always visit the official IRS or state government website for payment updates.

How These Payments Fit Into Broader Economic Relief Efforts

The $2400 and $550 direct payments are part of a broader effort by state and federal governments to support residents during difficult economic times. These programs, which also include stimulus checks, expanded child tax credits, and unemployment benefits, have helped lift millions of Americans out of poverty and reduced food insecurity.

Additional Financial Resources You Can Use

In addition to these direct payments, there are other programs available to help with financial struggles:

- SNAP (Supplemental Nutrition Assistance Program): Provides food assistance to low-income families.

- Energy Assistance: Programs like LIHEAP can help with heating and cooling costs.

- Rent Relief: Many states offer rent assistance programs for those struggling with housing costs.

For more information on these programs, visit USA.gov or your state’s official website.

How to Use Your Payment Wisely

While these relief payments are a great help, it’s important to manage the money responsibly. Here are some ideas on how to use the funds:

- Cover Immediate Needs: Use the payment for essential expenses like rent, utilities, and groceries.

- Pay Down Debt: If you have high-interest debt, consider using part of the payment to reduce it.

- Save for Emergencies: If you’re financially stable, use the payment to build an emergency fund or invest in your future.

Frequently Asked Questions (FAQs)

- How do I apply for the $2400 or $550 payment?

California’s $2400 payment didn’t require an application, but other states may require you to file taxes. Visit your state’s Department of Revenue for more details. - Can I still apply for payments in 2024?

California’s MCTR program is no longer offering payments in 2024, but states like New Mexico are still issuing relief payments this year. - What if I haven’t received my payment?

Ensure your tax filings are accurate and up to date. You can track your payment status on the IRS or your state’s government website.