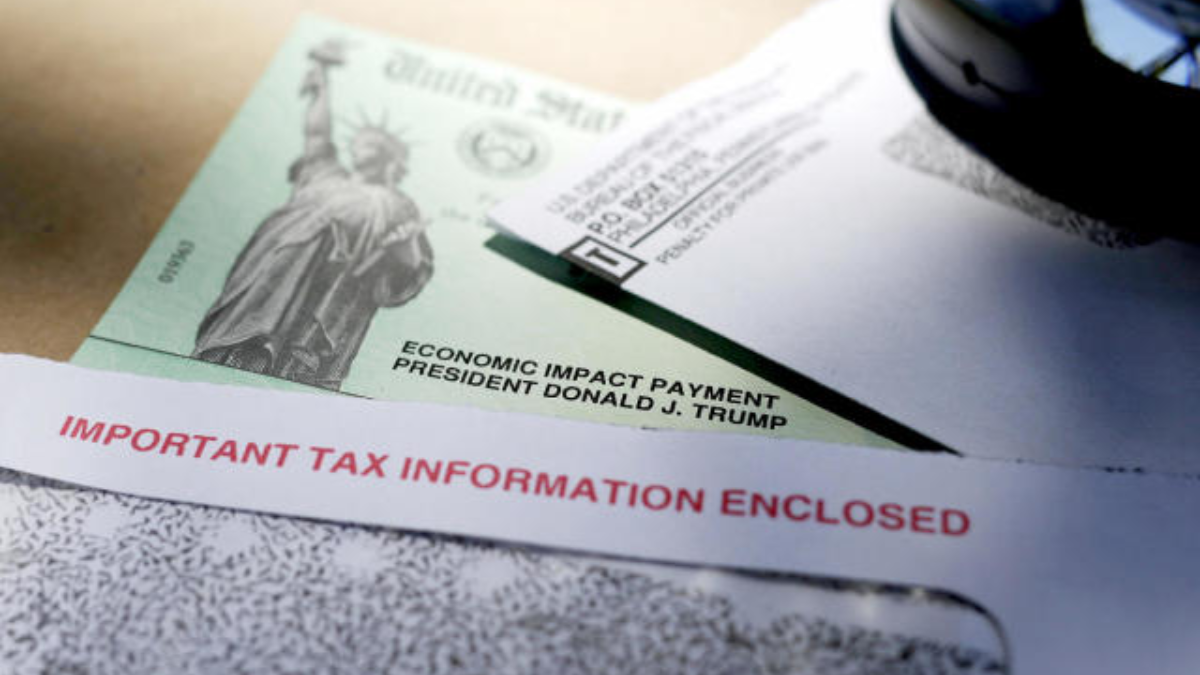

As stimulus checks remain a critical financial lifeline for millions of Americans, many are left wondering whether they qualify and how they can receive their payments. The IRS has streamlined the process, but questions about eligibility, payment methods, and timelines continue to surface. Here’s a detailed guide to answer the most pressing concerns about IRS stimulus payments.

Who Is Eligible for a Stimulus Check?

Eligibility for stimulus payments is determined primarily by income levels and tax filing status. Generally, individuals with an adjusted gross income (AGI) of up to $75,000 (or $150,000 for married couples filing jointly) are eligible for the full payment. The benefit phases out for higher income levels and becomes unavailable for individuals earning above $99,000 or couples earning over $198,000.

Other eligibility requirements include:

- U.S. citizenship or residency status.

- Possession of a valid Social Security Number (SSN).

- Not being claimed as a dependent on someone else’s tax return.

How Are Payments Distributed?

The IRS uses information from the most recent tax return (2020 or 2021) to determine eligibility and distribute payments. Automatic deposits are made to the bank account on file, while paper checks or prepaid debit cards are sent to the mailing address for those without direct deposit details.

For recipients of Social Security benefits or other federal programs, payments are automatically sent to the same account where benefits are typically received.

What If I Haven’t Received My Check?

If you believe you qualify but have not received your stimulus check, the IRS offers the “Get My Payment” tool on their website to track payment status. Common reasons for delays include:

- Incomplete or outdated banking information.

- Errors in tax return filings.

- Changes in income or filing status.

Do I Need to Take Any Action?

Most eligible individuals do not need to take additional steps to receive their payment. However, non-filers—such as those with little or no income—may need to provide their information using the IRS Non-Filers tool to claim their check.

For further details on stimulus payments and eligibility requirements, visit the IRS official page on Economic Impact Payments.

Final Thoughts

Stimulus checks aim to provide financial relief during challenging economic times, but understanding the process can help you avoid missing out. Whether through direct deposit or mailed payments, the IRS is working to ensure eligible Americans receive their benefits promptly.

Disclaimer – Our team has carefully fact-checked this article to make sure it’s accurate and free from any misinformation. We’re dedicated to keeping our content honest and reliable for our readers.