Good News for Retirees: President Biden’s recent signing of the Social Security Fairness Act brings big changes to retirement benefits, especially for public sector workers. This new law will restore fairness and significantly increase Social Security payments for many retirees, including those who have worked for the government or other public institutions.

What the New Law Means for Retirees

The Social Security Fairness Act aims to provide an average increase of $360 in monthly benefits for over 2.5 million retirees. For many people who dedicated their careers to public service, this legislation promises to improve their financial stability during retirement.

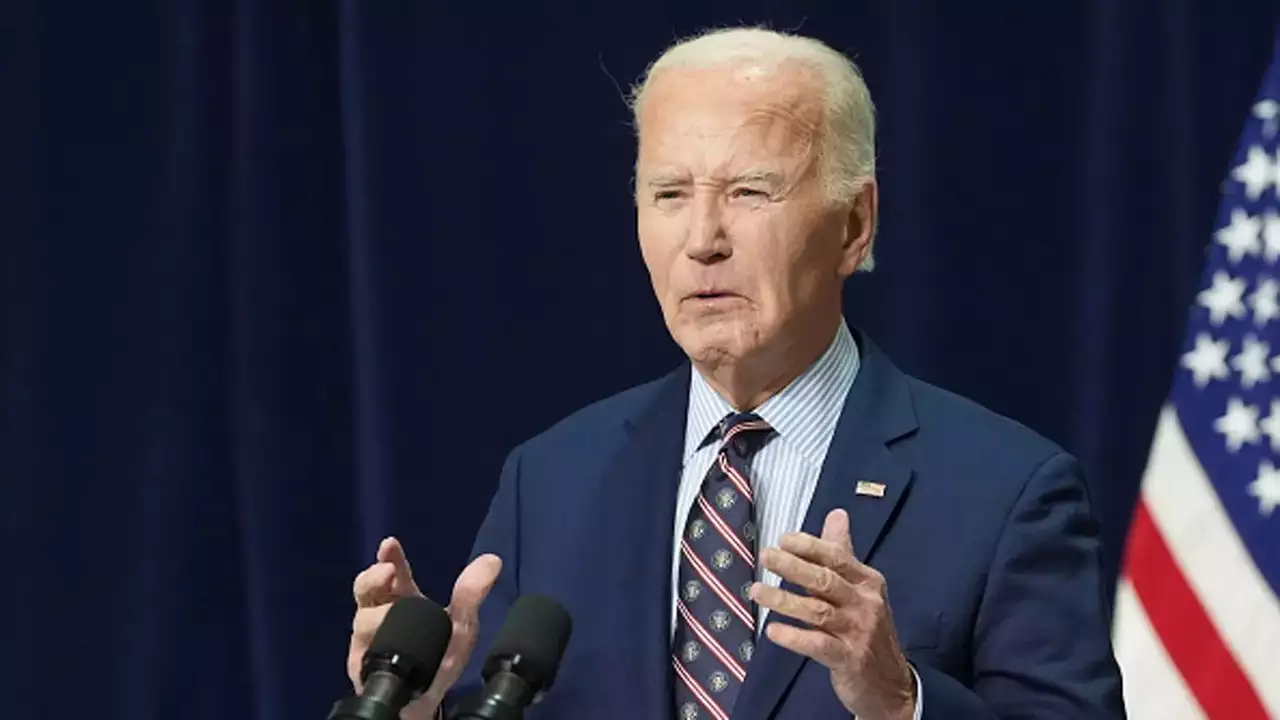

During a White House ceremony where he signed the bill, President Biden emphasized that hard-working Americans who have spent years serving the public deserve financial dignity in their retirement years. He also mentioned that this law would provide a lump sum payment to eligible retirees to compensate for the benefits they missed out on in 2024.

“I believe people who have spent their lives working hard and earning an honest living deserve to retire with financial stability and dignity,” Biden said.

The new law also ends policies that previously reduced the Social Security benefits of public workers, including the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

The Long Road to the Social Security Fairness Act

Efforts to improve Social Security benefits for those with public pensions have been going on for decades. In fact, Congress began addressing these policies back in 2003. However, it wasn’t until recently that substantial progress was made. After passing the House in November 2024, the Social Security Fairness Act was approved by the Senate in December with a 76-20 vote.

Despite bipartisan support, the bill faced some resistance from Republicans, mainly due to concerns about its cost. The Congressional Budget Office estimated that the law would increase the federal deficit by $195 billion over the next ten years. Despite this, the bill was finalized just in time for the end of President Biden’s term.

Key Changes in the Social Security Fairness Act

One of the major changes is the elimination of the Windfall Elimination Provision (WEP), which previously reduced the Social Security benefits of public sector retirees who also had pensions from their government jobs. Removing the WEP will increase monthly payments by an average of $360.

In addition, the law eliminates the Government Pension Offset (GPO), which reduced survivor benefits for the spouses of public sector workers. The removal of the GPO could increase benefits by an average of $700 for those receiving benefits based on a living spouse. Widows and widowers could see even larger increases, with an average rise of $1,190 per month.

This law is a big win for retirees, as it restores fairness to the system. For those who have been impacted by the WEP and GPO policies, the removal of these provisions will make a huge difference in their monthly Social Security payments.

The Financial Impact of the New Law

The Social Security Fairness Act promises significant financial relief to retirees, but its cost is substantial. The Congressional Budget Office estimates that the law will increase federal spending by $195 billion over the next decade.

The change will also be retroactive, meaning retirees will receive back payments for missed benefits in 2024. This will help address the financial strain that many retirees have been under due to lower-than-expected Social Security payments in recent years.

By the end of 2025, many retirees can expect to see their monthly Social Security payments rise significantly. For retirees who had been receiving partial benefits due to these provisions, they will now get their full benefits along with back pay for the previous year.

A Step Forward, But Not Without Challenges

While the new law is a major step forward, it’s not without its challenges. Experts warn that the financial strain on Social Security trust funds is still a concern, and the Social Security Administration will have to work hard to implement the changes smoothly.

Martha Shedden, president of the National Association of Registered Social Security Analysts, pointed out that while the law is a victory for retirees, it does not address the ongoing financial issues faced by the Social Security program itself.

However, the Social Security Administration has reassured beneficiaries that the process will be straightforward. No extra paperwork or action will be required, as long as beneficiaries have updated their mailing and direct deposit information. Most people can do this easily online through their “My Social Security” account, avoiding the need for in-person visits or phone calls.

The Bottom Line: A Win for Retirees

In conclusion, the Social Security Fairness Act is a win for public sector retirees. By removing the WEP and GPO provisions, millions of retirees will see a significant increase in their monthly Social Security payments. These changes, which will be retroactive to December 2023, will make retirement a little easier for many who had previously faced reduced benefits.

While the law has a high price tag, with an estimated cost of $195 billion over the next decade, it is a crucial step toward ensuring that public sector workers receive the benefits they’ve earned. Now, retirees can look forward to better financial security in their retirement years.

Disclaimer – Our team has carefully fact-checked this article to make sure it’s accurate and free from any misinformation. We’re dedicated to keeping our content honest and reliable for our readers.