Social Security isn’t just for individuals who’ve worked and contributed to the system—it also offers benefits for spouses. This program provides financial support based on your spouse’s work history, giving retired couples more options for financial planning.

Here’s everything you need to know about spousal Social Security benefits, explained in simple terms.

1. When Can You Claim for Spousal Social Security Benefits?

You can only claim spousal benefits once your spouse has started receiving their Social Security benefits. However, your spouse doesn’t need to reach full retirement age for you to qualify—you can still claim benefits if they are receiving either retirement or disability payments.

To be eligible for spousal benefits, you must meet the following conditions:

Minimum Age: 62 years old.

Special Exception: If you’re caring for a child under 16 or a disabled child who qualifies for benefits under your spouse’s work record, you can claim benefits at any age.

2. What Amount can You Receive as a Spouse?

The amount of spousal benefits depends on your spouse’s full retirement benefit. However, if you wait until your full retirement age to claim, you can receive up to 50% of your spouse’s benefit.

Here’s how it works:

– The Social Security Administration (SSA) will compare your spousal benefit against the amount you had received based on your own work history. You’ll get the higher amount.

– While applying for spousal benefits, you must also apply for your own retirement benefits. This rule, called “deemed filing,” ensures you can’t delay one benefit to maximize the other.

However, if you claim your benefits before reaching your full retirement age, the amount will be reduced. The reduction equals to 25/36 of 1% for each month you claim early for up to 36 months. For claims made more than 36 months early, the reduction is five-twelfths of 1% per month.

3. Should You Delay Claiming Spousal Benefits After Full Retirement Age?

While delaying your own Social Security benefits past full retirement age increases your payment by up to 8% annually until age 70, this rule doesn’t apply to spousal benefits.

The maximum spousal benefit is maxed at *50% of your spouse’s full retirement benefit*, no matter how long you wait. Delaying won’t increase the spousal payment, so there’s no financial advantage to waiting past your full retirement age.

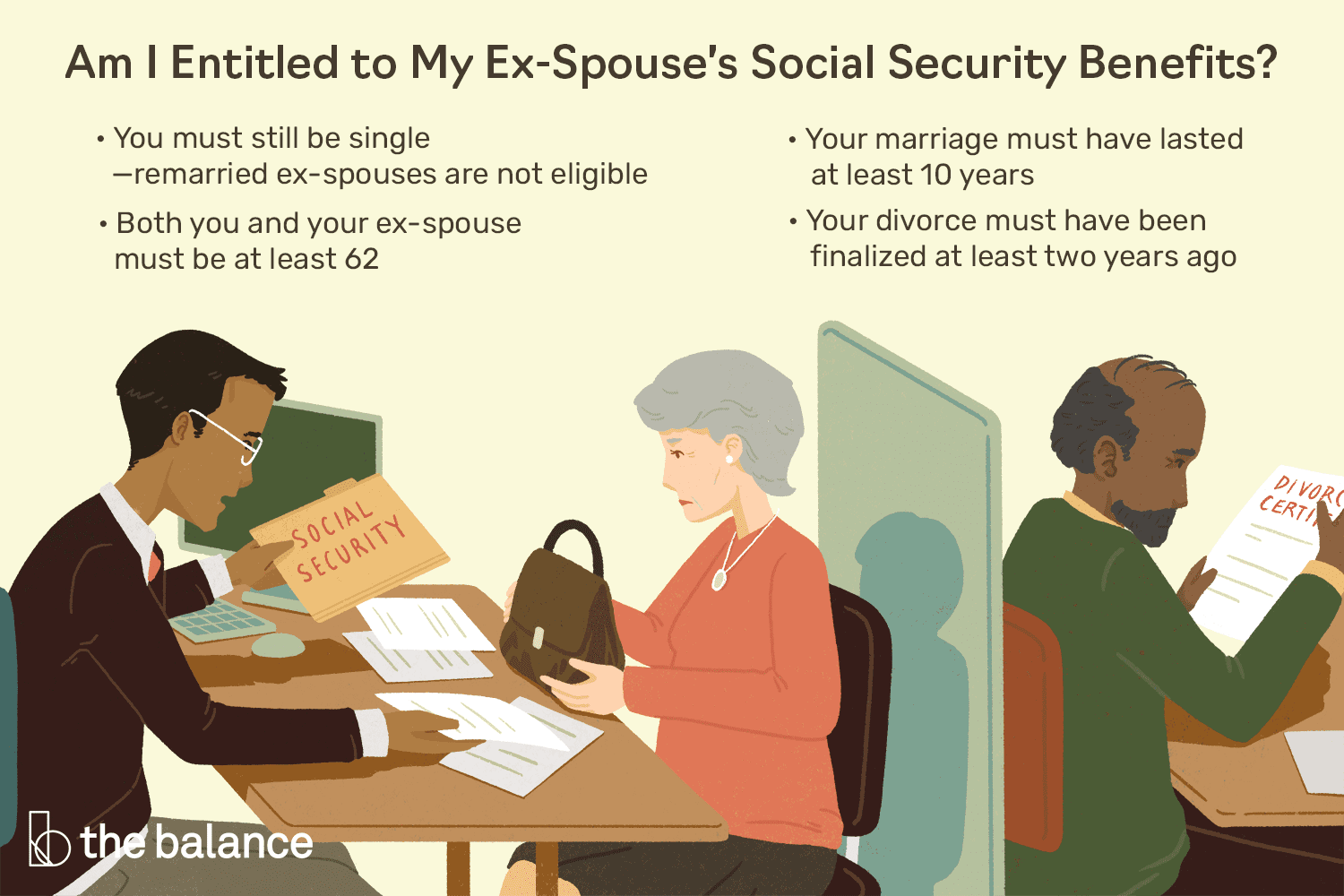

4. Can Divorced Spouses Claim Spousal Benefits?

Yes, divorced spouses may also qualify for Social Security benefits based on their ex-spouse’s work record, provided they meet certain conditions:

– Must have been married for at least 10 years.

– Currently unmarried.

– If your previous spouse hasn’t applied for benefits but qualifies, you can still claim if you’ve been divorced for at least two years.

The SSA also recognizes “valid non-marital legal relationships” in certain cases, so check with the SSA to see if you qualify.

Key Takeaways

Spousal Social Security benefits are an essential part of retirement planning for couples. By understanding when to claim, how much you can receive, and whether you’re eligible based on marital status, you can make informed decisions to maximize your financial security.

If you’re unsure about your benefits or need more information, visit the official Social Security website or contact the SSA directly.