Former President Donald Trump’s latest Social Security proposal aims to address concerns about the program’s long-term sustainability. However, while the plan introduces promising reforms, experts warn it may also lead to unintended consequences that could impact beneficiaries.

Overview of Trump’s Proposal

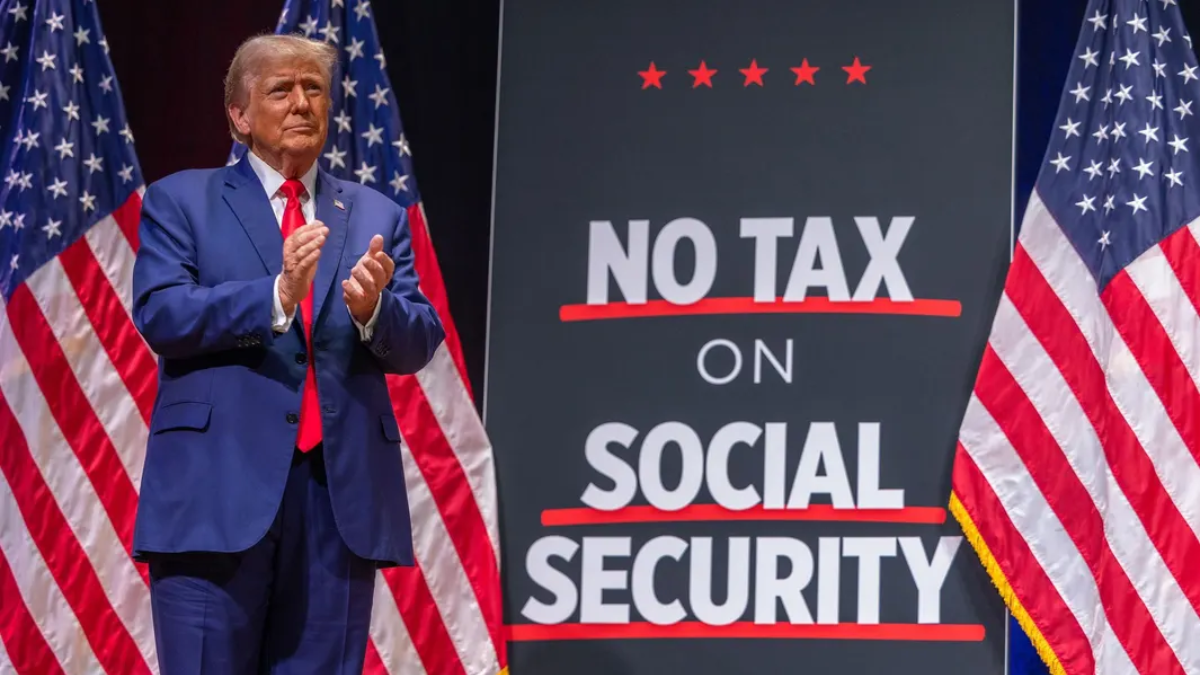

Trump’s proposal focuses on ensuring the solvency of Social Security without increasing taxes or reducing current benefits. Instead, it seeks to redirect funding from other federal programs and promote economic growth to support the system. The goal is to secure the program for future generations while maintaining benefits for retirees, survivors, and disabled individuals.

Trump has also suggested implementing optional private investment accounts, allowing younger workers to allocate a portion of their Social Security taxes to personal accounts. Advocates argue this would empower individuals with greater control over their retirement savings and potentially yield higher returns.

Concerns and Potential Consequences

While the proposal offers innovative ideas, critics highlight potential drawbacks:

- Funding Challenges: Redirecting federal funds could strain other critical programs, such as healthcare and education.

- Market Risk: Optional private accounts could expose individuals to market fluctuations, potentially reducing retirement income during economic downturns.

- Equity Concerns: Lower-income workers may not benefit equally, as they typically rely more heavily on traditional Social Security benefits.

A report by the Center on Budget and Policy Priorities highlights that privatization could introduce significant risks to beneficiaries who lack investment expertise.

Balancing Reform with Stability

Experts agree that Social Security reform is necessary to ensure its solvency. However, balancing innovative solutions with the program’s stability remains a critical challenge. Policymakers must weigh the benefits of private investment options against the potential for financial risk, particularly for vulnerable populations.

As discussions around Social Security evolve, it is vital for beneficiaries and lawmakers to consider both the short-term gains and long-term consequences of these proposals. Ensuring the program remains a robust safety net for all Americans is the ultimate goal.

For further analysis on these impacts, visit CBPP’s Social Security insights.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates.