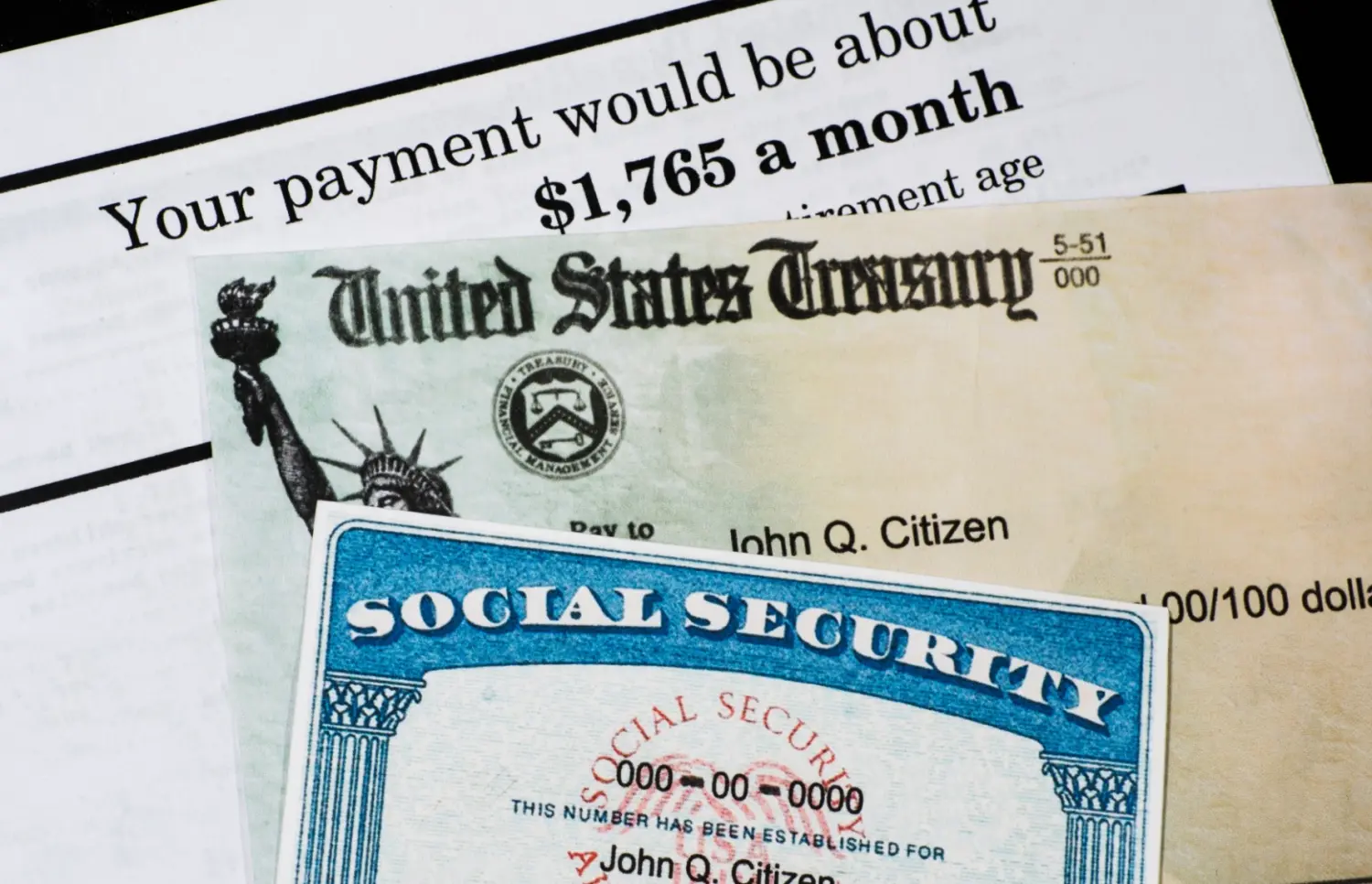

December 2024 is a critical month for millions of Americans who depend on Social Security benefits. This month, eligible recipients could receive payouts as high as $3,000. For those navigating retirement or financial planning, understanding how Social Security benefits are calculated, who qualifies, and how to maximize these payments can make a significant difference. This guide breaks down the essentials in straightforward terms to help you plan for your financial future effectively.

What is Social Security?

Social Security is a U.S. federal program offering financial assistance to retired workers, disabled individuals, and families of deceased workers. Created in 1935, it has become an essential safety net for many. By 2024, approximately 66 million people will receive monthly benefits.

A Quick History

The Social Security Act, enacted during President Franklin D. Roosevelt’s administration, marked a significant milestone during the Great Depression. Over time, the program expanded to include survivor benefits, disability benefits, and cost-of-living adjustments (COLA) to keep pace with inflation.

Key Facts About December 2024 Social Security Payments

| Feature | Details |

|---|---|

| Maximum Monthly Payment | $4,873 (if delayed until age 70 with high earnings) |

| Average Monthly Benefit | $1,927 (2024 average) |

| December Payment Dates | 2nd, 3rd, or 4th Wednesday of the month |

| Eligibility Requirements | Age, work history, and retirement credits |

Understanding these basics is crucial for optimizing your benefits.

How Are Social Security Benefits Calculated?

Your benefit amount depends on several factors:

- Lifetime Earnings: Higher earnings during your working years result in higher benefits.

- Retirement Age: Delaying benefits until age 70 increases monthly payments.

- Earnings Record: Benefit calculations consider your highest-earning 35 years, ensuring that long-term contributions to Social Security reflect in your payout.

- COLA Adjustments: These annual adjustments help your benefits keep up with inflation.

For a personalized estimate of your benefits, you can use the Social Security Administration (SSA) Quick Calculator.

Who Qualifies for the $3,000 Check?

The potential to receive up to $3,000 per month hinges on factors such as your work record and the age at which you begin to claim benefits.

- Retirement Credits:

To qualify for Social Security, you need 40 credits, equivalent to about 10 years of work. - Full Retirement Age (FRA):

- Born 1943–1954: FRA is 66 years.

- Born 1960 or later: FRA is 67 years.

- Postponing your claim until the age of 70 can notably enhance the amount you receive each month.

- COLA Adjustments:

A 3.2% COLA for 2024 ensures your benefits align with inflation. Higher COLA rates could increase payouts further in future years.

Examples:

- High Earners: Workers with maximum taxable earnings who delay retirement to age 70 may exceed $3,000 monthly.

- Dual-Income Households: Couples can combine benefits strategically to maximize payouts.

How to Check Your Benefits

Follow these steps to ensure you’re receiving the correct amount:

- Create a My Social Security Account

Visit the SSA website and register using your details. - Verify Your Earnings Record

Check for errors in your earnings history, as inaccuracies can lower your payout. - Use the Retirement Calculator

Estimate how different retirement ages affect your benefits. - Review Other Benefits

Even if retirement is far off, check survivor and disability benefits eligibility.

When Will Payments Arrive?

Payment schedules depend on your birth date:

- 1st–10th: Paid on the 2nd Wednesday.

- 11th–20th: Paid on the 3rd Wednesday.

- 21st–31st: Paid on the 4th Wednesday.

If you receive Supplemental Security Income (SSI), payments are usually issued on the 1st of each month.

Tips to Maximize Your Benefits

- Work Longer

Replace lower-earning years with higher-earning ones to boost your payout. - Delay Claims

Waiting until age 70 increases benefits by up to 32% compared to claiming at age 62. - Coordinate with Spouses

Couples can strategize by having one claim benefits early while the other delays. - Plan for Taxes

For individuals whose total income surpasses specific thresholds, up to 85% of their benefits might be subject to taxation. Strategies include:- Using Roth IRA withdrawals, which are tax-free.

- Seeking advice from a financial planner to minimize taxes.

FAQs About December 2024 Payments

Q: Can I work while receiving benefits?

Yes, but if you’re under FRA, benefits may be reduced if earnings exceed $21,240 in 2024.

Q: Will Social Security run out of funds?

While the program faces challenges, it is expected to pay full benefits until 2034. Afterward, payroll taxes could cover 77% of scheduled benefits.

Q: What happens if I claim benefits early?

Starting benefits at age 62 reduces payouts by 25–30% compared to waiting until FRA.