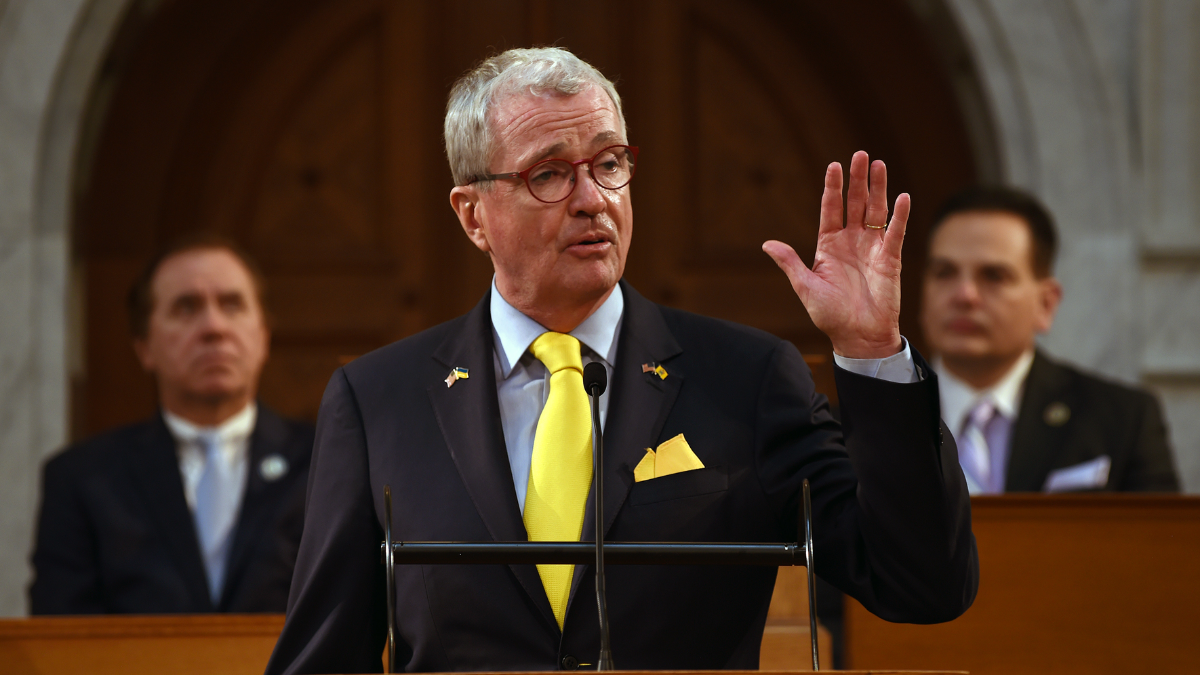

As Governor Phil Murphy approaches the conclusion of his tenure, his administration has introduced a series of tax increases that have ignited discussions across New Jersey. These fiscal measures, embedded within the state’s $56.6 billion budget for fiscal year 2025, aim to address funding shortfalls in critical sectors such as transportation and education. However, they have also raised concerns among businesses, commuters, and residents about the broader economic impact.

Corporate Transit Fee Targeting High-Earning Businesses

A cornerstone of the new budget is the introduction of the Corporate Transit Fee, which imposes a tax hike on businesses with annual net incomes exceeding $10 million. This measure elevates the top corporate tax rate from 9% to 11.5%, positioning New Jersey among the states with the highest corporate tax rates in the nation. The revenue generated is earmarked to support NJ Transit, the state’s beleaguered public transportation system facing a nearly $1 billion budget gap. Governor Murphy’s administration estimates that this tax will generate approximately $1 billion in its first year.

While the administration views this as a necessary step to ensure reliable public transit, business groups have expressed strong opposition. They argue that the increased tax burden could deter investment and stifle economic growth, particularly as companies recover from the economic downturn caused by the COVID-19 pandemic. Critics contend that such a tax could make New Jersey less competitive compared to neighboring states, potentially prompting businesses to relocate.

Gas Tax Increase Addressing Infrastructure Needs

In addition to corporate taxes, the budget includes a 2.6-cent per gallon increase in the state’s gas tax, effective January 1, 2025. This adjustment raises the total gas tax to 44.9 cents per gallon. The increase is part of a statutory requirement to ensure sufficient funding for New Jersey’s Transportation Trust Fund, which finances critical infrastructure projects across the state.

State Treasurer Elizabeth Maher Muoio emphasized the necessity of this adjustment, stating that it aligns with the state’s commitment to maintaining and improving transportation infrastructure. However, this increase arrives at a time when residents are already grappling with rising living costs, leading to concerns about the financial strain on commuters and the potential for increased costs of goods due to higher transportation expenses.

Electric Vehicle Fee Balancing Green Initiatives with Revenue Needs

In a move that has surprised many environmental advocates, the new budget introduces a $250 annual fee on electric vehicles (EVs), set to increase by $10 each year for the next four years. This fee aims to offset the loss of gas tax revenue as more drivers transition to EVs, ensuring that all vehicle owners contribute to the maintenance of road infrastructure.

While the intention is to create a fair contribution system, critics argue that this fee could discourage the adoption of environmentally friendly vehicles. Senator Bob Smith, a Democrat, described the fee as a “serious policy mistake,” suggesting it contradicts the state’s environmental goals and efforts to reduce carbon emissions.

Budget Highlights Investments Amidst Tax Increases

Despite the controversy surrounding the tax hikes, the fiscal year 2025 budget outlines significant investments aimed at enhancing the quality of life for New Jersey residents:

- Property Tax Relief: The budget allocates over $3.5 billion for direct property tax relief, continuing programs like the ANCHOR Property Tax Relief Program, which has provided substantial aid to homeowners and renters in recent years.

- Education Funding: An increase of $908 million in direct K-12 aid brings total school funding to nearly $12 billion. This investment aims to fully fund the state’s school aid formula for the first time, ensuring equitable resources for students across all districts.

- Public Pensions: For the fourth consecutive year, the state will make a full payment into New Jersey’s pension system, reflecting a commitment to fiscal responsibility and the long-term financial health of public retirement funds.

- Affordable Housing: More than $50 million is designated to boost New Jersey’s housing supply, including funds for down payment assistance and incentives for creating accessory dwelling units. This initiative seeks to address the housing affordability crisis and support first-time homebuyers.

Political and Public Response

The introduction of these tax measures has elicited a mixed response from lawmakers and the public. Democratic leaders have largely supported the budget, emphasizing the necessity of these taxes to fund essential services and infrastructure. Assembly Speaker Craig J. Coughlin highlighted the budget’s focus on making New Jersey “an affordable place to work, raise a family, and retire.”

Conversely, Republican leaders and business advocacy groups have criticized the tax increases, suggesting they could hinder economic growth and disproportionately impact middle-class families. They point to the significant growth in annual spending over Murphy’s tenure, rising from $34.7 billion to $56.6 billion, and question the sustainability of such fiscal policies.

Looking Ahead The Legacy of Governor Murphy’s Fiscal Policies

As Governor Murphy prepares to leave office, the long-term effects of these tax increases remain a topic of debate. Supporters argue that the additional revenue is crucial for maintaining and improving the state’s infrastructure, education system, and public services. They contend that these investments will yield economic benefits that outweigh the immediate costs.

For further details on New Jersey’s budget and tax changes, visit NJ Spotlight News.

Disclaimer – Our team has carefully fact-checked this article to make sure it’s accurate and free from any misinformation. We’re dedicated to keeping our content honest and reliable for our readers.